Daniel Hopsicker

The man who facilitated the purchase of several DC-9's for SkyWay Aircraft in St. Petersburg Florida was the company's largest shareholder, Doug McClain Sr.'s Argyll Equities. So how did he get such an important job in such a thriving Enterprise?

The man who facilitated the purchase of several DC-9's for SkyWay Aircraft in St. Petersburg Florida was the company's largest shareholder, Doug McClain Sr.'s Argyll Equities. So how did he get such an important job in such a thriving Enterprise?

During the 90's, Doug McClain Sr. belonged to an organized crime ring run by Robert Colgin Wilson, an obese six-foot-five-inch con man, who—according to the Wall Street Journal (“High, Wide &…” Feb 24, 1997— fast-talked investors in the U.S. and Canada out of more than $100 million in the 1990's alone.

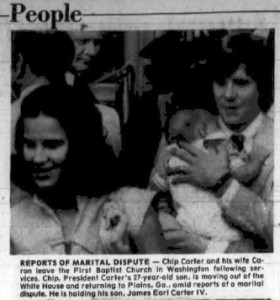

“Wilson dazzled his victims by treating them to jaunts to Las Vegas and the Cayman Islands on his luxurious corporate jets, promising super-high returns in supposedly risk-less investments, and employing high-profile, unwitting company directors –among them Chip Carter, son of the former President, and Carter budget chief Bert Lance,” the Journal reported.

“At one point Wilson was hawking his loan-finding services with Dennis Levine, who had been jailed in the 1980s with Ivan Boesky in an insider-trading scheme.”

Not every name in organized crime ends in a vowel

In the early 1990’s Wilson’s crew pulled off a signature fraud against a Christian organization in New York State, called the Cleft in the Rock Foundation.

In the early 1990’s Wilson’s crew pulled off a signature fraud against a Christian organization in New York State, called the Cleft in the Rock Foundation.

Wilson and McClain were joined by a number of accomplices, who we will learn more about when the Cleft in the Rock Foundation swindle is explored in depth. Tracking Wilson and McClain’s confederates—Samuel L. Boyd, Gary Long, Robert Carter Dye, Peter Dale, Dieter Wicki, and James Garro—will lead to other partners in the criminal conspiracy…

Like the Butcher brothers, Jake and his brother C.H. Butcher, Jr., whose rise to control of a $3 billion financial empire in Tennessee is a tale filled with fraud, suicide, adultery, cocaine and Indian gambling that rivals anything on popular TV shows of the time like Dallas or Dynasty.

The brothers brought a Worlds Fair to Knoxville. Jake won the 1978 Democratic nomination for Tennessee governor. His brother C.H. Butcher, Jr owned 22 banks in Tennessee and Kentucky which were declared insolvent by federal investigators, triggering the fourth-largest bank failure in US history up to that time.

The brothers brought a Worlds Fair to Knoxville. Jake won the 1978 Democratic nomination for Tennessee governor. His brother C.H. Butcher, Jr owned 22 banks in Tennessee and Kentucky which were declared insolvent by federal investigators, triggering the fourth-largest bank failure in US history up to that time.

And Chip Carter, Jimmy Carter’s eldest son, who was in a small bar in Mexico Beach, Fla., drinking beer on the afternoon of July 20, 1977 with the skipper of a boat he’d chartered before, when his Dad, the President, Jimmy Carter, called and suggested he get out of town immediately, just before federal agents swooped in and busted his drinking buddies in a drug raid that netted a boat just offshore carrying four tons of Colombian marijuana.

Chip Carter & Bert Lance

There were no allegations at the time that the unlucky Chip Carter was involved in drug trafficking. But he was obviously impressed with the New Money in the New South, and it would have been hard not to be. Later, after he began working with Robert Colgin Wilson, he was very impressed that a meeting Wilson called was attended by a former vice president of the World Bank.

There were no allegations at the time that the unlucky Chip Carter was involved in drug trafficking. But he was obviously impressed with the New Money in the New South, and it would have been hard not to be. Later, after he began working with Robert Colgin Wilson, he was very impressed that a meeting Wilson called was attended by a former vice president of the World Bank.

And who wouldn't be?

Then there’s Bert Lance, and his son C. Beverly Lance, two of Robert Colgin Wilson's less innocent partners.

When Wilson went to federal prison after pleading guilty to wire fraud, conspiracy and tax evasion in a scheme they were both involved in, part of the deal was that the plaintiffs agreed that the Lance's had been duped, and dropped them from their civil suit. It was a gesture that probably did not go unrewarded.

When Wilson went to federal prison after pleading guilty to wire fraud, conspiracy and tax evasion in a scheme they were both involved in, part of the deal was that the plaintiffs agreed that the Lance's had been duped, and dropped them from their civil suit. It was a gesture that probably did not go unrewarded.

And Manuel Bello, whose history of stock manipulation brought him in contact with McClain, became famous in an old political scandal that is today ancient history.

Bello, a close associate of New England Mafia boss Raymond Patriarca, was doing time in federal prison, when two aides to the House Speaker, Democrat John McCormack of Massachusetts, used his office to try to pull some strings and get Bello released on probation.

“Robert Wilson’s Enterprise.”

But what is of immediate interest is that it was as one of Robert Wilson’s henchmen that Doug McClain learned of a template—which I learned dated all the way back to the 1950’s— used by organized crime to defraud and “bust out” coal companies.

But what is of immediate interest is that it was as one of Robert Wilson’s henchmen that Doug McClain learned of a template—which I learned dated all the way back to the 1950’s— used by organized crime to defraud and “bust out” coal companies.

Much of what follows is condensed from contemporary news accounts as well as the decision issued by District Judge Spatt of the Eastern Division of the U.S. District Court of New York.

The law firm representing Cleft, which seemed well-connected locally in New York, included former mayor (from 1978 through 1989) of New York Ed Koch .

As always, Robert Colgin Wilson was the “central figure” in the case.

Doug McClain worked for Wilson as the Director of Wilson’s Euro America Insurance Company Limited, and an officer in others of Wilson’s various and constantly shifting business entities.

His duties ran the gamut of financial fraud. In November of 1993, for example, McClain delivered, on Wilson’s behalf, $100 million of counterfeit Mexican bonds to a broker-dealer in Saint Louis called Pauli & Co.

His duties ran the gamut of financial fraud. In November of 1993, for example, McClain delivered, on Wilson’s behalf, $100 million of counterfeit Mexican bonds to a broker-dealer in Saint Louis called Pauli & Co.

The scheme to defraud detailed in the complaint was called the “Robert Wilson Enterprise.” It involved entities and individuals in the United States, Canada, Barbados, Ireland, Switzerland, the Channel Islands, and numerous other locations throughout the world, making his organization the very definition of transnational organized crime.

“Trinity. Triad. And Genesis”

The fun begins with Douglas McClain, by then a Wilson lieutenant, and Jack Kenny, a broker at Dean Witter in Saint Louis, who managed an account opened there by McClain in the name of Trinity Capital.

The fun begins with Douglas McClain, by then a Wilson lieutenant, and Jack Kenny, a broker at Dean Witter in Saint Louis, who managed an account opened there by McClain in the name of Trinity Capital.

(“Trinity”—as those who keep track of Iran Contra connections will recall— is a code word from that operation. Everyone from Barry Seal to Adnan Khashoggi to the Bass Brothers in Texas used it to name business entities.)

Much later, when Kenny later felt investigators closing in, he notified the Federal Bureau of Investigation of the counterfeit bonds, turned informant, and received a light sentence when the conspiracy collapsed.

McClain brought Kenny into Wilson’s orbit in 1990. Wilson impressed Kenny as a very “together” businessman, and said Wilson was an easy man to like: Rich and well-connected, he had business partners that included James “Chip” Carter, son of former President Carter, and Thomas Bertram “Bert” Lance, the Carter administration budget director.

Kenny said Wilson claimed to be “a large currency trader with accounts at various European banks.”

“He was very impressive. This guy is flying around in a $50 million jet, and there I am in meetings with guys like Chip Carter,” Kenny told one reporter.

“He was very impressive. This guy is flying around in a $50 million jet, and there I am in meetings with guys like Chip Carter,” Kenny told one reporter.

“I flew out with Wilson one time to a business meeting at McClellan Air Force Base in Sacramento, and the way the military treated him, it was like King Tut was walking in.”

King Tut on a U.S. Air Force Base

Why would an element of the U.S. military—Air Force officers at McClellan AFB, roll out the red carpet for Wilson? In court proceedings and news accounts, I can find nothing to indicate anyone ever asked the question, or determined an answer.

McClain initiated contact with the Cleft of the Rock Foundation in New York several years later. The Foundation’s lawsuit alleged, and the court agreed, that the defendants stole $3.99 million.

McClain initiated contact with the Cleft of the Rock Foundation in New York several years later. The Foundation’s lawsuit alleged, and the court agreed, that the defendants stole $3.99 million.

With the importance of Doug McClain and Robert Wilson’s relationship established, its time to move on to that relationship’s relevance to Doug McClain’s Last Big Play in the coal fields of Kentucky.

Back in 1978, according to an appellate decision of the Fifth Circuit of the United States Court of Appeals which can be found online, Wilson was convicted along with a Beverly Hills brokerage owner named Howard Carroll, for fraud in the sale of securities for a coal mining company they jointly founded called Coal Creek Mining Company.

Prospective investors were told the proceeds would develop mining properties for the production of coal. Instead, the money they raised in a stock offering bought Texas real estate, and some good times in Vegas.

Prospective investors were told the proceeds would develop mining properties for the production of coal. Instead, the money they raised in a stock offering bought Texas real estate, and some good times in Vegas.

Carroll and Wilson formed the mining corporation, arranged for the sale of stock, and arranged for their names not to appear as the company’s owners and promoters, selecting a “front man” named Harry Niles to run the company and appear as majority stock owner when Carroll and Wilson were the true owners and retained actual control.

“The boys from Beverly Hills”

Beverly Hills brokerage owner Howard Carroll must have been quite a character, because he had been convicted on essentially the same charges almost 20 years earlier.

Beverly Hills brokerage owner Howard Carroll must have been quite a character, because he had been convicted on essentially the same charges almost 20 years earlier.

All I could find describing the fraud was a 1964 decision affirming Carroll’s conviction in 1957 from the Ninth Circuit of the U. S. Court of Appeals, written in a humorous acerbic tone that you can’t find in Appeals Court decision these days.

Carroll was convicted of using the stock of a Nevada mining company called Comstock, Ltd., whose shares were listed on the San Francisco Mining Exchange, to defraud investors.

Carroll was convicted of using the stock of a Nevada mining company called Comstock, Ltd., whose shares were listed on the San Francisco Mining Exchange, to defraud investors.

The judges relate a teletype conversation which took place between two of Carroll’s offices showing them colluding to set the price of the stock in the mining venture.

“OK kid been working like a demon Comstock will be 33-40 in few minutes as soon as exchange opens,” types one.

“We have it worked out now and if your boys going to sell any they should do it quick-like.”

“OK Wonderful What price will we sell at now so as to correspond to market?”

“Well I would wait ten minutes until the market opens and then check with Aronson and see how its quoted. NY is retailing it at 40 a healthy price! Yes.”

The appellate judges then added their own droll take: “Comment by us seems superfluous.”

No hay comentarios:

Publicar un comentario