True Detective: Chicago, El Chapo, & Vince Vaughn’s Mom

True Detective 2: “The Vaughn Addendum”

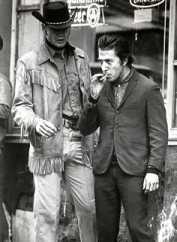

True Detective 3: “The Cowles’ Identity”

Daniel Hopsicker

True Detective 2: “The Vaughn Addendum”

True Detective 3: “The Cowles’ Identity”

Daniel Hopsicker

In 2003, Directors Performance Fund, a hedge fund controlled and run by Sharon Vaughn, mother of actor Vince Vaughn, capitalized a “bank” specializing in providing financing to drug traffickers and snake oil salesmen peddling goat’s blood.

The deal received attention only after Vaughn’s hedge fund went fully rogue two years later, in a much larger financial scam which caught the eye of the SEC first, before becoming the subject of a federal criminal investigation that resulted in federal charges against three men.

Hedge funds typically take positions on behalf of their clients in the stock of a number of different companies. One bad investment does not usually make or break a hedge fund manager’s career.

However, during the three-year lifespan of Sharon Vaughn’s hedge fund, she only made four investments.

Two were small potatoes. One was with Argyll. Her fourth and final investment was such an all-time loser that she never had the opportunity to make another one.

Today its thanks to Actor Vince Vaughn’s recent comments on gun control that a closer look at the financial imbroglio surrounding Sharon Vaughn's unusual investments revealed the outlines of what—after all other options are ruled out—must be an operation sanctioned by high officials in the U.S. Government during both the Bush and Obama Administrations.

So—credit where credit is due—before delving into the astonishing story of what happened next at Sharon Vaughn’s hedge fund, a quick look at Vince Vaughn’s controversial quotes to GQ magazine in the UK about gun control, and how he went from amiable Wedding Crasher to gun-slinging NRA poster boy and unlikely darling of the Right.

"Star of Dodgeball's deep thoughts on weighty matters "

If the star of Dodgeball (and True Detective) thinks the solution to school shootings is more guns on campus, that is, of course, his right.

"The greatest defense against an intruder is the sound of a gun hammer being pulled back,” Vaughn told British GQ magazine in "Vince Vaughn Brings the Heat!"

“In all of our schools it is illegal to have guns on campus, so again and again these guys go and shoot up these fucking schools because they know there are no guns there.”

“Banning guns is like banning forks in an attempt to stop people getting fat,” Vaughn continued. His ideas about turning schools into defacto National Armories to keep kids safe ignited a predictably incendiary response in the Twittersphere…

Of course, it’s easy to read too much into Vaughn’s remarks. The stars of screwball comedies do not, after all, appear on Meet The Press.

Also, his carefully honed comic persona was working against him. As one movie fan wrote on his IMDB page, “If I'm zapping (channel surfing) and see him, I immediately think ‘this movie must be really dumb.”

But that wasn’t the end of Vince Vaughn's comments. He went on to link owning guns with another notion “We have the right to bear arms to resist the supreme power of a corrupt and abusive government.”

And in the light of what happened next at Sharon Vaughn’s hedge fund, that notion— of a supremely powerful and corrupt U.S. Government with nothing better to do than harass financial fraudsters trying to make a dishonest buck—sounds more than a little self-serving.

Who knows? Maybe it has something to do with Vince and Sharon Vaughn’s hometown, Lake Forest Illinois.

“Let me tell you about the rich. They’re different from you and me.”

It was, of course, F Scott Fitzgerald who wrote that line, in a 1926 short story called The Rich Boy, about people who live in Lake Forest, Illinois.

For decades Lake Forest was known as the home of Scott Fitzgerald’s lost love, Ginevra King, the real person fictionalized as Daisy Buchanan, the heroine in arguably the greatest American novel ever written, Fitzgerald's “The Great Gatsby.”

For almost a hundred years Chicago’s industrial elite (Rockefellers, Armours, Medills, and Marshall Fields) called it home. It was a haven for robber barons and meat packers, far from the strikes, riots, and muckrakers that threatened the wealth' and safety of the early 20th century’s one per cent.

Vince Vaughn and his mother Sharon Vaughan are from Lake Forest Illinois. She stills lives there, in a $1.3 million McMansion she shares with her second husband, Stephen Ferrone.

Here’s a few things to know about the city of Lake Forest, nestled along Lake Michigan, a comfortable 30 miles north of downtown Chicago:

It’s the Greenwich Connecticut of the Midwest. It’s white (92 per cent), and rich (median income for a household is $150,670, for a family more than $200,000.)

“The sole bar in town has only one piece of graffiti in the men’s room,” wrote one recent visitor, “over the urinal, in neat script. It read ‘Ameritech management sucks.’ Which tells you everything you need to know about Lake Forest.”

“I ate lunch at a restaurant today which had three different autographed Vince Vaughn photos,” wrote someone else who visited there recently.

It’s horsy. There’s fox hunting. There’s show jumping. Most of all, there’s polo.

During the Roaring Twenties, it was the posh sport of polo’s westernmost outpost. It once hosted an historic polo match called the "East-West clash of 1933, which marked the first time a team of "Westerners" (today Midwesterners) beat the best players from ‘Back East.’

The match was described, somewhat self-importantly, as a "gleaming moment in American polo, if not the very zenith of the game in this country."

Ginerva King's family raised the first polo ponies in Lake Forest, at the family’s Lake Forest mansion called “King-dom Come.” Who says Midwesterners can’t be droll?

In the Great Gatsby, Daisy’s husband Tom Buchanan’s polo ponies were said to have been bred in Lake Forest. Fitzgerald’s harsh judgment of them is famous: “They smash things up and retreat into their money, or vast carelessness, or whatever it is that keeps them together, leaving other people to clean up the mess.”

Apparently, not much has changed.

Sharon Bets The Ranch

Sharon Vaughn’s last investment—in which she bet the ranch, more than $24 million, almost every penny in her hedge fund—is to hedge fund investment what The Matrix is to reality.

There’s no there there.

“Securities regulators say American Trade Industries was a sham company at the center of a scheme in which promoters promised extravagant returns from a government-backed group,” the SEC complaint stated.

She gave the money to three mis-matched fraudsters’— Richard Warren, 63, David Myatt,41, and Frank Cowles Jr. 76, —whose newly-incorporated Nevada shell company, American Trade Industries (ATI), has no office or assets.

A year later all three men will have been arrested and charged with conspiracy, wire fraud, and money laundering.

“Three businessmen, including a director of a Virginia bank, swindled a Lake Forest investment fund out of $25 million in a fraudulent deal that promised profits of 10 percent per week, prosecutors said Tuesday,”reported the local Chicago Tribune.

"In a criminal complaint filed by Fitzgerald on Tuesday, Cowles was accused of lying to a hedge fund manager, who was not identified, about the nature of a $25 million investment. According to the complaint, Cowles and two associates induced the hedge fund manager to make the investment, promising 10 percent profit per week in a deal that they claimed was being overseen by a Federal Reserve administrator," reported the Washington Post.

They were running what the SEC calls a “Prime Bank Scheme.” Promoters claim they have special access to secret markets, supported by government entities like the Federal Reserve, which result in guaranteed exorbitant returns, with no risk to investor’s principal,

There’s also a little garnish on the side: A certain percentage of the profits must be diverted to worthy causes, because otherwise the Fed won’t participate. Richard Warren, for example, told Sharon Vaughn he was working with one of Laura Bush’s charities.

Big Red Flag # 9

The financial fraud at Sharon Vaughn’s hedge fund began to unravel in 2004. According to the SEC, that’s when the hedge fund began cooking the books to conceal what is in retrospect a very minor loss in currency trading.

“In July 2004, it was clear that the $500,000 (loss from currency trading) was likely gone for good,” states the criminal affidavit used to indict the three men for stealing $24 million from her hedge fund.

“The Eclipse (currency trading) loss was netted against Argyll’s gains and DFG’s accountant simply removed the currency trading program from the Fund’s balance sheet.”

In plain English, the SEC complaint is saying that Vaughn used profits from her investment in Argyll to hide her losses in currency speculation.

This is a big red flag, one of several places where the “official story” bears little or no resemblance to what is referred to as “consensual reality.” The reason is simple.

There are dozens of lawsuits by individuals or business entities that sued Argyll for fraud or in a fruitless attempt to get their money back; those who profited as the result of investments made with Argyll are as rare as National Geographic Wildlife Special on unicorns.

Meaning…there aren’t any.

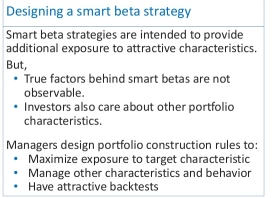

"The Beta Strategy"

It turns out that Sharon Vaughn’s hedge fund was as phony as Doug McClain’s investment bank.

The hedge fund distributed to potential investors a memorandum lining out the hedge fund's investment strategy. They called it the Beta Strategy. “Our methodology has produced consistent and impressive results over the past several years,” stated the prospectus.

From the SEC complaint: “The Memorandum disclosed that the Fund’s Beta Strategy “generally involves purchasing, directly from issuers, dealers and institutional bond desks, government and other high-quality debt of various maturities, determined to present minimal credit risk.”

"The Memorandum’s representations about the Fund’s “proprietary” “Beta Strategy” were false when made."

None of the investments fit within the scope of the Fund’s “permitted investments” or the “Beta Strategy,” and none of the investments are “high quality debt securities.”

In reality: DFG did not develop or have any ownership rights to the Beta Strategy.

Rather, DFG and Eichengreen copied the Beta Strategy language from the prospectus for another hedge fund that had no connection to DFG.

Neither Vaughn nor Eichengreen knew what the original Beta Strategy was.

Ouch.

Live by the sword

Because of her famous son, when Sharon Vaughan’s hedge fund went down in flames there were big bold headlines everywhere from Rupert Murdock’s tabloids to Forbes magazine.

“Aren't Hedgies Supposed to Be Smarter Than Us?” asked Mark Stein, in Business Journal.

“A new case from the Securities and Exchange Commission contends that even sophisticated wealth managers can get caught up in investments that sound — and are — too good to be true,” he reported.

“How Vince Vaughn’s Mom Lost $25 Million” was a Dealbook headline on June 16 2006.

“Vince Vaughn’s acting career is going strong these days, but his mother’s role as a high-end money manager seems to have flopped, big time.”

“…Her strange saga includes some fast-talking characters who allegedly bilked her fund out of $25 million, including $2 million of Ms. Vaughn’s own cash. Ms. Vaughn faced civil fraud charges herself, and she ended up agreeing to a lifetime ban from the securities industry.”

Sharon Vaughn’s fall from grace was fodder across a broad spectrum of the American media, from TMZ and People to Hedge Fund World and Forbes. It was so juicy that even business reporters couldn’t resist snarky show-biz references.

In “Option This Case,” Forbes magazine journalist Carrie Coolidge wrote “Court filings in the case resemble a treatment for a cheesy comedy movie.”

“While undergoing an audit, Sharon Vaughn went to authorities, then secretly taped conversations, which led to arrests and in March fraud indictments. Vaughn herself escaped prosecution, but the SEC, appalled by what might politely be called her poor investor disclosure and inattention to detail, pursued two civil proceedings against her.”

When the tabloids start interviewing business journalists, its never a good sign.

“She was incredibly naïve,” Forbes magazine’s Coolidge dished to the New York Daily News. “Who would believe you’d get a 10 per cent return every month – and that they’d also donate a portion of the proceeds to charity?”

Perhaps Coolidge is merely attempting to allow Vaughn to maintain the shred of dignity that befits a hedge fund manager. Still, there are two big mistakes in her brief quote.

First, the criminal indictment doesn’t say Vaughn was being promised a ten per cent return per month. Like a hustler in Times Square selling Rolexes for $29.99, the scamsters were promising Sharon Vaughn a return of ten per cent per week.

As anyone in Chicago will tell you, even loan sharks don’t earn that kind of juice on their loans. And running a hedge fund supposedly differs from “putting money on the street.”

“Not her first rodeo”

Coolidge’s other, even bigger mistake was in unquestioningly accepting the ridiculous assertions—otherwise known as the “official story”—being peddled by Justice Department officials in the case.

This wasn’t Sharon Vaughn’s first rodeo. She was a respected financial adviser for more that a decade. No one achieves that kind of status by being unable to spot a proposition that’s too good to be true.

Yet neither Coolidge nor any other journalistic account I’ve read raised an eyebrow.

Coolidge mockingly asks, “Who would believe…” as if there were no question that Sharon Vaughn fell for big talk of making huge returns while donating money to charity.

“She was incredibly naive,” Coolidge asserts.

Really? I think it's Coolidge who’s being naïve. I don’t think smart savvy & experienced Sharon Vaughn did believe it.

Something else must be the case.

"A riotously successful hedge find"

An unofficial Hollywood bio on UK celebrity news site Talk Talk focused on what the scandal meant for Vince Vaughn’s budding relationship (at the time) with Jennifer Aniston.

It deserves to be quoted here, mostly because its description of Sharon Vaughn having had a “riotously successful hedge fund” had never been used in either show biz gossip or financial reporting.

“Despite his blossoming relationship with Aniston, there were black moments. One involved his mother Sharon and her Directors Financial Group, a riotously successful hedge-fund she ran from home. Problems arose when Sharon was offered an investment that, it was claimed, would generate 10% a month as well as extra funds earmarked for charities. To most this would sound too good to be true. But Sharon didn't think so, and was righteously burned when the scheme was revealed to be a scam.”

“Righteously burned” Sharon was the subject of a Securities and Exchange Commission complaint claiming she'd failed to properly invest her clients' money.

Though she aided authorities in their investigation,wore a wire when introducing a Secret Service agent to one of the perps, surrendered profits of $808,820 and was banned from associating with any investment adviser or broker, Sharon Vaughn was not completely out of the woods.

"Undergoing an audit, Vaughn went to authorities, then secretly taped conversations, which led to arrests and in March a fraud indictment against one promoter, who has pleaded not guilty. Vaughn herself escaped prosecution, but the SEC, appalled by what might politely be called her poor investor disclosure and inattention to detail, pursued two civil proceedings against her," reported Forbes magazine.

If Sharon Vaughn ever gave investigators an explanation for her suspicious investment, its not in the court record. To this day, no official explanation has been forthcoming. Calls to the SEC in Chicago went unanswered.

After criminal trials and convictions in San Diego, and SEC complaints and settlement agreements in Chicago, the reasons for Sharon Vaughn's investments in Argyll and ATI remain shrouded in mystery.

As we'll see tomorrow in True Detective III: "The Cowles Identity" that's probably not an accident.

No hay comentarios:

Publicar un comentario