True Detective: Chicago, El Chapo, & Vince Vaughn’s Mom

True Detective 2: “The Vaughn Addendum”

True Detective 3: “The Cowles’ Identity”

Daniel Hopsicker

True Detective 2: “The Vaughn Addendum”

True Detective 3: “The Cowles’ Identity”

Daniel Hopsicker

According to the DEA—which, caveat emptor, lies like a dog when it suits its purposes—El Chapo Guzman’s Sinaloa Cartel “supplies 80% of the heroin, cocaine, marijuana and methamphetamine, with a street value of $3 billion, that floods Chicago each year.”

Though it seldom comes up, that flood flows both ways. And since the money from a ton of cocaine is several times the volume of the cocaine itself, the flood of drugs into Chicago must resemble a tsunami of cash surging back to Mexico. Only… it doesn’t.

Sure, you can ship $20 million back to Mexico in a couple of 18-wheelers. But three-quarters of the money made in the U.S. from drug trafficking never leaves the country. Its much easier to take possession of your loot—already laundered—in the form of a loan from a corrupt American bank, of which there is no shortage, or a criminal enterprise pretending to be a bank, like Argyll Equities.

It wasn’t exactly “When Harry Met Sally.”

There is reason to be suspicious of everything about the couple, including how they met.

It used to be called Presidente Stroessner International Airport, just outside Paraguay’s capital. It was

named for Paraguay’s long-time dictator, General Alfredo Stroessner, whose 35-year reign of terror made South American history.

Whoever called it the banality of evil knew what they were talking about: after a coup by his closest confidant forced him into exile in Brazil, Stroessner died from complications from a hernia.

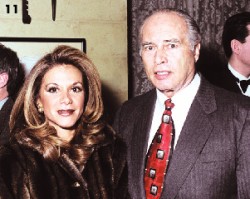

Several coups later, it was called Asuncion Airport, when Frank Cowles—who will later allegedly talk Sharon Vaughn out of $25 million—met a well-educated and accomplished Paraguayan beauty named Teresa Leila Rachid.

Cowles was in town—supposedly— to purchase a finca in the jungle where he planned to develop a second ranch, when the two just bumped into each other at the luggage carousel, or some similar nonsense. That’s according to later interviews with the widow Cowles.

But think about it. By the late 90’s, when Frank-met-Leila, he was already pushing 70. And isn’t carving out your own Southfork Ranch in a trackless jungle wilderness a young man’s game?

And it’s widely known that old men don’t cover as much ground as they used to. So why wasn’t Cowles’ huge 755 acre cattle ranch, Arabian horse-breeding farm and antebellum mansion In the Virginia countryside outside Washington D.C. already large enough?

Whatever he was doing in Paraguay, its safe to say he wasn’t there looking to become the next J.R.; back home in Virginia, he already was.

Consider what follows, then draw your own conclusion.

“3 face charges in Lake Forest fund scheme”

The indictment against Frank Cowles, and two other men, was unsealed in November 2005.

“Three businessmen, including a director of a Virginia bank, swindled a Lake Forest investment fund out of $25 million in a fraudulent deal that promised profits of 10 percent per week, prosecutors said Tuesday,” reported the Chicago Tribune, Sharon Vaughn’s local paper.

The lead in Cowles’ hometown paper, the Washington Post, was all about him.

“Frank L. Cowles Jr. is known in the Northern Virginia business community as the owner of car dealerships and a founding director of Virginia Commerce Bank in Arlington. Now, at age 76, he is facing allegations of a criminal conspiracy to defraud an Illinois hedge fund out of $25 million.”

The other two men were an afterthought; they were said to be implicated with Cowles, leaving the clear implication that he was the mastermind.

“According to the criminal complaint, Cowles is the secretary of American Trade Industries Inc. Richard E. Warren, 63, of Fredericksburg, identified as the president of American Trade, and “associate” David L. Myatt, 41, of Los Banos, Calif., were implicated with Cowles in the alleged conspiracy.”

David Myatt was arrested at his California home Nov. 12 and was released on $300,000 bond, reported the Post.

Sensing the jig was up, Warren attempted to flee, and got as far as boarding a plane for London before being taken into custody while attempting to flee the country at Dulles Airport. It seemed he was clearly going to be in detention for a while.

Warren had already been in trouble with the SEC, the Post reported. The US District Court in Northern California in 1998 had issued permanent injunctions enjoining Warren from securities law violations—a chastisement Warren apparently did not take to heart— and ordered the disgorgement of $7.2 million.

Everything seems just a little bit…off

Sharon Vaughn, called “the unidentified hedge fund manager” in the story, was unable to get the men to provide a written accounting of where the $25 million investment was being held, the complaint said.

A closer look at the criminal affidavit filed by Secret Service Agent Jonathon Sawant offers some interesting tidbits. Warren bragged to David Myatt, it states, that he had a Federal I.D. from the Federal Reserve, where his contact was Fed Vice Chairman Roger Ferguson.

Warren told Myatt he also worked deals for the Pentagon, as well as the Fed, and he said he (Warren) had to send documents to the National Security Agency for approval, including passports, bios, and proof of funds.

In a statement which must have raised a few eyebrows in Washington, Myatt confirmed to investigators that both Warren and Frank Cowles had Federal I.D. issued by the FBI.

According to the affidavit Warren told Sharon Vaughn that he “had a special government clearance,” and was “licensed by the US Government to participate in secret trading programs.”

A jury later found him guilty on 11 counts of wire fraud, and he was sentenced to 200 months (16 years) in prison. That’s a long time for an old man (he’s now 68) to spend in prison. Today, Warren, from his sinecure in the Terre Haute Federal Correctional Institution, maintains a lively dialogue with the U.S. District Court.

U.S. Court of Appeals Judge William Bauer, denying Warren’s latest appeal, commented wryly:

“Warren, who is pro se, argues in this direct appeal that the district court lacked both personal and subject‐matter jurisdiction because he is a “citizen of God’s Kingdom and not of Earth.” He has made the same frivolous argument 42 times in papers filed in the district court, to no avail.”

Three businessmen… and a lady

“Three businessmen, including a director of a Virginia bank, swindled a Lake Forest investment fund out of $25 million in a fraudulent deal that promised profits of 10 percent per week, prosecutors said Tuesday,” reported the Chicago Tribune, Sharon Vaughn’s local paper.

The indictment against the three men was unsealed in November 2005.

A few months later charges against one of the three will be dropped. Pop quiz: Based on recent American history, can you name the man who walked?

Also, which one of the three was the criminal mastermind leading poor Sharon Vaughn astray?

Richard E. Warren, from Fredericksburg, Va., had already been in trouble with the SEC. The US District Court in Northern California in 1998 had issued permanent injunctions enjoining Warren from securities law violations, ordering the disgorgement of $7.2 million.

It was a chastisement Warren apparently did not take to heart.

An ‘in’ at the Fed

Warren bragged to David Myatt, a still wet-behind-the-ears fraudster, that he had a Federal I.D. from the Federal Reserve. His contact was Fed Vice Chairman Roger Ferguson.

Warren said he worked deals on behalf of the Pentagon, as well as the Fed. Warren used to tell Myatt he had to send documents to the National Security Agency for approval, including passports, bios, and proof of funds.

Both Warren and Frank Cowles had Federal I.D. issued by the FBI, Myatt confirmed to investigators.

Richard Warren told Sharon Vaughn that he “had a special government clearance,” and was “licensed by the US Government to participate in secret trading programs.”

At the end, sensing the jig was up, Warren attempted to flee, and got as far as boarding a plane for London before being taken into custody. A jury later found him guilty on 11 counts of wire fraud, and he was sentenced to 200 months (16 years) in prison.

That’s a long time for an old man (he’s 68) to spend in prison. Today, Warren, from his sinecure in the Terre Haute Federal Correctional Institution, maintains a lively dialogue with the U.S. District Court.

U.S. Court of Appeals Judge William Bauer, denying Warren’s latest appeal, commented wryly:

“Warren, who is pro se, argues in this direct appeal that the district court lacked both personal and subject‐matter jurisdiction because he is a “citizen of God’s Kingdom and not of Earth.” He has made the same frivolous argument 42 times in papers filed in the district court, to no avail.”

Warren’s musings don’t sound like those of a devious criminal mastermind capable of hoodwinking a savvy financial consultant like Sharon Vaughn.

That’s leaves David Myatt and Frank Cowles.

Another Minister’s Boy

The second man, David L. Myatt of Los Banos, Calif., a minister’s son and a deacon in a California church, is in many ways the most interesting of the three.

He’s also a link between the ATI fraud, the Argyll fraud, and the one in Newport Beach.

Doug McClain Sr., readers will recall, was a fundamentalist minister in a leadership position in a Christian cult called the Move, which was active in the Santa Cruz area near Myatt’s Father’s ministry.

Another connection between Myatt and McClain is yet-another preacher’s son, named Brent Leiske. Leiske was a key player in the attempted billion dollar fraud in Newport Beach, where he assisted a purported CIA agent named Alex Chelak.

Myatt said he met Leiske through a friend at church.

Who hooked them up with Sharon Vaughn?

Myatt did an interview with prosecutors in Chicago while looking to cut himself a deal. In it, he stated he met Richard Warren while working with Leiske. Leiske was doing the same kind of trading as Warren. When Myatt’s contract with Leiske was up, he asked Warren about working with ATI.

Myatt’s interview with investigators goes in considerable detail. Curiously it contains no reference to how the group was introduced to Sharon Vaughn.

“In 2003 Myatt was working as a painter earning $5500 a month,” states Sawant’s criminal affidavit. “During this same period of time he began working several hours a week for John Brent Leiske for no payment. Myatt said he did the work for free to learn about the investments Leiske was working on.”

Today Myatt refuses to answer questions about his ties to Leiske, Cowles, Vaughn, or his 16 months in prison. He sees himself as a sort of Biblical Joseph, calling his life story The Joseph Experience. offering

Today, at Pray International, he is once more ministering to God’s sheep, although the fact that he thought to trademark it means he keeps a foot down here in the fallen world.

Still, David Myatt was just the acknowledged ‘go-fer’ for the group.

In recognition of his minor role, got only 16 months in prison, so apparently he was not the criminal mastermind.

The”Official Story meets “Reality”

Frank L. Cowles, the third man indicted in the scheme, operated on a far higher level of society from the other two men. He was a wealthy Arabian horse breeder with a sprawling horse farm in the Virginia countryside outside Washington D.C.

And he was married to Leila Teresa Rachid-Cowles, the beautiful and well-connected Foreign Minister of Paraguay. and one of the top officials in a country so corrupt that the president’s official limo was a stolen car from Brazil.

She confirmed as much in an interview.

“When President Argaña was assassinated in 1999, the only armored vehicle in Paraguay was this (stolen) BMW,” she explained. “Of course, the new president took it. It was the only car in all of Paraguay that could protect the president. Nobody worried if all the documents were in order.”

Frank and Leila were a power couple in two capitals, in Asuncion Paraguay and Washington DC, where they were regular attendees at the Meridien Ball. They were there for the Valentine’s Day “Tickle Me Pink Party” at Marcel’s.

Despite his wife’s diplomatic status, Frank Cowles very undiplomatically shot her in the middle of what must been a particularly dark and stormy night in November of 2007.

Frank plugged his wife in the abdomen ”accidentally,” according to press reports, which described her as being in “in serious but stable condition.”

While Leila eventually recovered, the story received attention befitting glittering socialites. In the aftermath of the shooting, Cowles was reported to have habitually slept with a gun underneath his pillow.

As if that explained everything.

“Fraud charges dropped against ex-bank director”

Frank Cowles, Jr. faced charges with the help of a high-powered attorney, Robert Luskin, from Washington D.C., who tangled with and bested U.S. Attorney Patrick Fitzgerald in another case, as Fitzgerald attempted to charge Luskin’s client Karl Rove with perjury.

But at least Frank was ahead of the curve. The headline in the March 16 2006 story in the Chicago Tribune—“Fraud charges dropped against ex-bank director”— will become depressingly familiar over the next few years.

“A U.S. District Court judge in Chicago dropped criminal charges against Cowles on March 1 2006 after the U.S. attorney’s office there filed a motion to dismiss. Assistant U.S. Atty. Jacqueline Stern said in court Cowles was cooperating with investigators. The case continues against Richard Warren and David Myatt, who are accused of wire fraud.”

Cowles told the Washington Post he was “ebullient” that the charges were dismissed. Perhaps fearing that a more conservative audience might find the word obscure or elitist, he tone it down a little for the Washington Business Journal, telling them merely he was “very relieved.”

Cowles said he lost “millions of dollars” from his dealings with former partner Richard Warren. “This thing was a bombshell when it broke,” Cowles said.”I’m a former policeman and Marine — and I’ve never had a blemish on my record. After a very, very exhaustive three-and-a-half month investigation, they came up with the right conclusion.”

“A victim of the scheme”

Cowles’ attorney, Robert Luskin at D.C.-based Patton Boggs, says Cowles is “someone who has lived a long and honorable life without so much as a traffic ticket.”

“To have something like this happen to him is like having a safe dropped on him,” Luskin says. “To have these charges dismissed and be able to say, without even the need for a trial, that he was not involved in this is incredibly important to him.”

Perhaps feeling a little “ebullient” himself, attorney Luskin went on to tell reporters his client had been the victim of a scheme that cost him a great financial loss.

“This was a mistake,” Luskin said. “The person that was thought to be the predator was actually the prey Frank Cowles was “not involved in this.”

We arrive now at a major fork in the road between the “official story” and what really happened. Because a quick check of court documents in the case suggests the possibility that attorney Luskin’s statement is true correlates closely with the possibility that pigs can fly.

Bank Chairman Frank Cowles… Victimized Again

Here’s a bombshell investigators must wish no one had discovered: Frank Cowles had already been involved in a “prime Bank” scheme several years before, one in which he claimed to have lost $3.2 million dollars.

Motilall L. Sudeen was a native of Guyana, perhaps coincidentally also the home of Michael Francis Brassington, pilot and drug smuggler of note whose exploits have been covered in this space in dozens of stories.

Sudeen was a pharmacist and a radio evangelist in New Orleans during the 1980’s (he incorporated the Moti Sudeen Evangelistic Corporation in Chalmette, Louisiana). He turned a New Orleans area pharmacy into a successful international pharmaceutical business.

Prosecutors said he swindled more than $17 million by representing himself as a “trader” of medium-term notes (MTNs) with exclusive access to a secret overseas market.

What does a backwoods evangelist do with all that loot? One thing Sudeen—who is clearly no dummy—spent money on was the purchase of a ranch in Mississippi said to have magical properties: it was owned by former Louisiana Governor Edwin Edwards.

Notwithstanding being in the good graces of the former Governor, who, if memory serves, was himself in federal prison at the time, Sudeen was convicted in Federal Court in 2002 of running a “Prime Bank” fraud, the exact type fraud that several years later Frank Cowles will himself be directing, though, apparently, in a people-friendly non-criminal way.

Sudeen and an accomplice were convicted on all counts in a 38-count indictment which charged him with conspiracy, wire fraud, interstate travel in furtherance of a scheme to defraud, and money laundering.

He had access to secret, exclusive investment opportunities not available to the general public, Sudeen told potential investors, which would return 15 to 50 per cent monthly. Sudeen falsely represented that the “high yield trading program” involved “prime banks” and was engineered, monitored and controlled by the U.S. Treasury or the Federal Reserve Bank.

Enter Frank Cowles

“One of the investors listed in the indictment, Northern Virginia car dealer Frank Cowles, was first approached by Sudeen in London in the fall of 1998,” reported The New Orleans Times-Picayune.

In papers filed in a civil lawsuit by Cowles against Sudeen, Cowles claimed he ended up losing $3.4 million in Sudeen’s investment scheme. His reason? He was impressed with Sudeen’s supposed international trading in fertilizer, he said.

At the time he was supposedly defrauded by a pharmacist in Louisiana, Frank Cowles was chairman of Virginia Commonwealth Bank. Yet Frank Cowles is listed as being one of Sudeen’s victims.

A bank chairman, with a huge Arabian horse operation, a much-younger trophy wife who doubles as the Foreign Minister of Paraguay… yet somehow the official story would have us believe Cowles is something of a slow learner.

If you believe this is anything but an insult to the intelligence of every American citizen, please stop reading immediately and seek out recreational activities that don’t involve moving your lips.

The Cowles’ Identity

Its no surprise that Frank Cowles was the criminal mastermind of the group. What may come as a surprise is that Cowles is also the man against whom charges were unceremoniously dropped. Still, someone took Cowles involvement in the case pretty seriously. His bail was set at $1 million.

Some of the fun in demolishing the official story is diminished by the fact that Frank Cowles is dead, having committing suicide in 2010. When he shot himself, he was alone in his mansion, with only his wife as a witness. Because he’d shot her several years earlier, her testimony must be taken with at least a grain or two of buckshot.

Here are a few extracts from the affidavit and criminal indictment. before Frank Cowles was discharged from the case. It appears a massive mis-carriage of justice occurred.

Someone must be found to answer a simple question: Why?

“Myatt and Vaughn talked to Cowles about the default judgment against Warren. Cowles told them it was not a problem and that Warren was in the process of trying to get his $40 million from the court.”

“On or about October 21, Individual 1 (Vaughn) flew from Chicago to Washington DC to meet with Warren… She was met at the airport by Frank Cowles, who drove her to a meeting with Warren at a hotel… where she met with Warren and Cowles.

“On of about November 1, 2005, Individual 1 (Sharon Vaughn) had a tape-recorded conversation with Cowles, which included the following:

Cowles said that he had talked with Warren and all necessary paperwork had been submitted to the Fed Administrator, and he was expecting to receive a wire on Friday”

“Cowles said that he would personally take the documents to Warren for signature, and the would (then) take the documents to Myatt for signature. Cowles said that they would send the documents to the proper authorities so the wire could be cut.”

“Individual 1 (Vaughn) asked what bank the monies would be coming from. Cowles said that he did not know. Cowles said that based on his experience, no one ever knows what bank.

“Cowles said that the monies are routed to a disbursement bank and from there to a bank in the United States. Cowles said that the purpose is to mask the transaction so no one will be able to ‘back-track’ and identify the investor.”

“Cowles said that the Fed Administrator has the final authority concerning when the monies will be returned. He said that Warren was in Washington on business and would not be able to communicate for the remainder of the day.”

“Cowles said that he was the Chairman of the Virginia Bank of Commerce, and he was one of the founding members of the Virginia Bank, which has assets of approximately $1.6 billion. Cowles also said he was on the Board of Directors. (A representative from Virginia Commerce Bank said tat Cowles is on the Board of Directors for the bank at this time.)”

“Myatt said that Warren is going to meet Cowles in Hong Kong. Myatt said that ATI bought a plane a G4 (Gulfstream IV) that can go as far as Europe but not Asia, but Myatt did not know whether they would be taking the plane.”

“On or about November 10 2005 Individual 1 had a tape-recorded conversation with Cowles which included the following: “Cowles said that Warren had not been able to get a plane ticket, and therefore had not gone to London. Cowles stated that Warren would be going to London on Friday (Nov 11,2005.)”

“Cowles said that the Fed Administrator would release the profits to Individual 1. She then had to pay Myatt $500,000. Once they could prove that Myatt had been paid, the Fed Administrator would release the $25 million.”

“Cowles talked about two different trading opportunities and Individual 1 said that she was going to talk to Warren that afternoon.”

“Cowles said that the funds will be released by the Fed Administrator after Individual 1 paid Myatt. Cowles said that the Fed Administrator will not release payment until Individual 1 shows proof of paying Myatt.”

“Cowles stated that Individual 1 was not truthful with them and that Individual 1 gave them a false affidavit. Cowles said that Individual 1 lied to them about what she did versus Myatt.”

There’s more. Much more. But you get the idea.

What’s going on?

No hay comentarios:

Publicar un comentario